Strategic challenges for regional transport

Posted: 3 April 2006 | | No comments yet

The market for regional passenger transport in Germany has changed tremendously during recent years. Liberalisation began in 1996 with the law to regionalise local transport. New competitors emerged and quickly gained a substantial market share. Currently, however, the market is facing some major challenges. Competition is becoming more intense, the amount of tenders will soar while the government funding level will decrease. This will lead to prices going down, a challenge DB Regio and our competitors must meet.

The market for regional passenger transport in Germany has changed tremendously during recent years. Liberalisation began in 1996 with the law to regionalise local transport. New competitors emerged and quickly gained a substantial market share. Currently, however, the market is facing some major challenges. Competition is becoming more intense, the amount of tenders will soar while the government funding level will decrease. This will lead to prices going down, a challenge DB Regio and our competitors must meet.

The market for regional passenger transport in Germany has changed tremendously during recent years. Liberalisation began in 1996 with the law to regionalise local transport. New competitors emerged and quickly gained a substantial market share. Currently, however, the market is facing some major challenges. Competition is becoming more intense, the amount of tenders will soar while the government funding level will decrease. This will lead to prices going down, a challenge DB Regio and our competitors must meet.

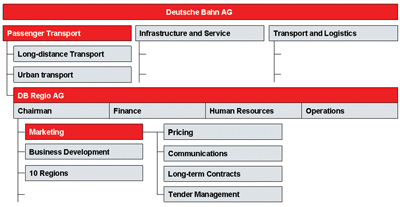

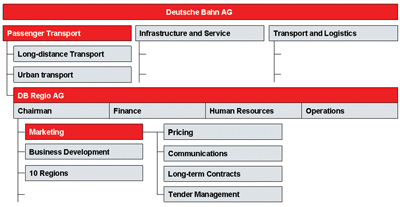

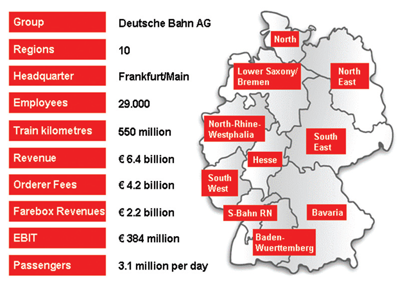

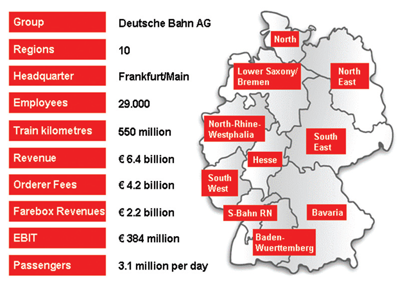

DB Regio AG

DB Regio belongs to Deutsche Bahn group and is Germany’s largest provider of local passenger services with a market share of 87 per cent in 2005.

With a strong focus on the customer and on operational economy, the company has a lean, market-driven organisational structure. The local transport companies and subsidiaries are assigned to the relevant regional management unit. They, in turn, report directly to the board of management and, as direct negotiating partners for the public ordering organisations of the Laender, are responsible for business performance in the regions.

The head office of DB Regio in Frankfurt is responsible for new business and concentrates on the general specifications and customer support functions for the regional units in the case of transport contracts and tenders. It also supports the regions with transport planning expertise and IT tools.

Regional transport market in Germany

Approximately 90 per cent of the German network is owned by DB Netz and is responsible for the running and management of the DB tracks. DB Netz is owned by Deutsche Bahn AG but is legally independent and ensures a fair access to the tracks as required by the EU regulation.

1996 witnessed the passing of the law that allowed local transport to be regionalised. This transferred the responsibility for the provision of services and costs for local rail transport from the Federal Government to the Laender. The Laender were then able to decide for themselves how much they were going to invest in rail services and which provider to use for what services. Normally, the Laender found some kind of ordering institution that then takes on the responsibility of the bidding process.

The regional transport market has an overall volume of approximately 630 million train kilometres and 8 billion Euros. Basically, the Laender have two options to assign service-contracts. Either they bring them to tender or they freely negotiate contracts with the train operating companies on the basis of transparency and non-discrimination. Free negotiation has dominated the market so far. However, there is a clear tendency that the Laender increasingly tender parts of the transport service. By 2005 approximately 125 million train kilometres, or 20 per cent of the whole network, was part of a call for tender. DB Regio AG has won 47 per cent of the tendered volume since 1996. In the future an additional 5 per cent of the overall market will be tendered each year so that in 2020 almost every route will have been tendered at least once.

On the German transport market, there are around 300 licensed transportation companies active in the standard-gauge railway sector and 60 companies in the rail-related regional transportation sector with an aggregated market share of 13 per cent in 2005. These companies split into two classes: large international transportation companies as Connex or Arriva and local or regional public companies.

Market trends

We envisage four major trends in the German regional transport market in the near future:

1. Intensifying competition

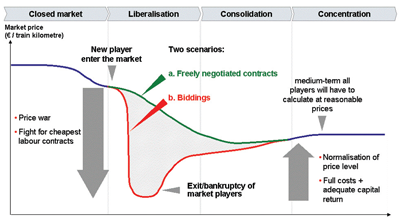

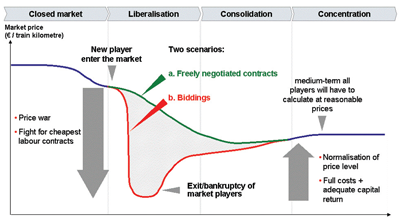

Due to its overall volume and the increasing number of biddings the German market is one of the most attractive in Europe. Several international organisations have already entered the market and others are planning to do so. Additionally, local or regional public companies expand their business within or into regional transport. Abellio and Hamburger Hochbahn are two examples of the latter. In the near future we expect the number of competitors to rise further. Thus, morecompanies are competing for one bid. We have observed that new entrants, especially, are willing to price aggressively for strategic reasons. They want to build up a position from which they can benefit from synergies and economies of scale as soon as possible. Moreover, public companies that are not on a watch by the capital market partly neglect capital return and do price at marginal costs. Therefore, we expect the prices to further decrease. At some point, however, we are convinced that the market will consolidate and consist of fewer larger competitors and that ultimately prices will come to a reasonable level again.

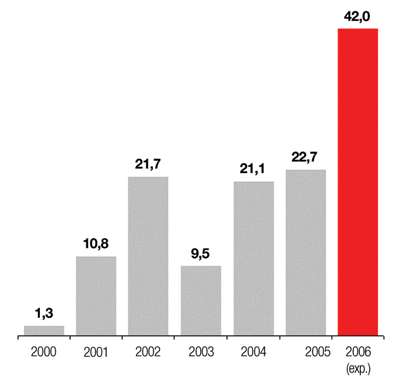

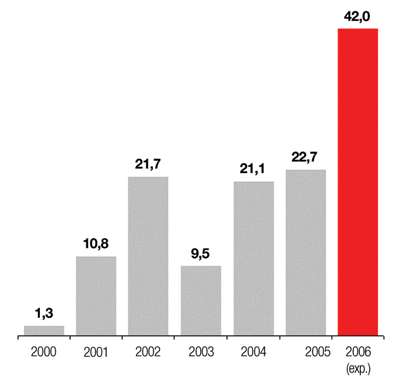

2. Increasing number of tenders

In 2006 approximately 42 million train kilometres are expected to be called for tender which would almost be double the amount of the previous peak in 2004. As the volume per tender is not expected to rise, the amount of tenders will increase proportionally meaning higher handling and transaction costs for the companies undertaking the bids. The tendency of an increasing amount of tenders will last for the next years as the first wave of tender contracts assigned in 1996 is now going to be issued a second time. Overall, this trend is likely to accelerate the consolidation of the industry because the handling costs of bidding exceed the limits of smaller companies.

3. Focus on passenger oriented requirements in biddings

Ordering institutions increasingly put emphasis on passenger oriented requirements. They require unlimited access to the product and service for all potential passenger segments, including handicapped persons and families. Professional education of the staff is becoming a deciding factor in the bidding process, as well as the willingness of train operating companies to continuously train its employees. Last but not least, passenger information has become an important issue. Ordering institutions often require the operators to grant passengers the entitlement to receive current and correct information and to deliver sophisticated data to use in various information systems.

4. Rising importance of passenger fares

Two forces are driving down the price level within the market: the intensified competition described above and government decision to cut back funding from the regionalisation law by ten per cent. All transportation companies are now facing the challenge to compensate losses from the public side by increasing passenger revenues. An easy solution might seem to be increasing fares. Theis possibility is limited, however, especially if one takes the actual economic situation of Germany and the decreasing net income of German households into consideration. The other option is to generate more volume. Train operating companies have to attract new customers by launching innovative products and pricing offers. Additionally, they must tie existing customers to their own company and trigger them to travel more often.

DB Regio’s strategy and market outlook

Considering the current dominant position and the intensified competition, it is inevitable that DB Regio will lose market share over the next few years. However, the long-term goal is to keep a share of more than 70 per cent in the German market. Thus, we also have to raise our success rate in biddings up to this rate, a goal we want to achieve through innovation.

In the market of ordered services we understand ourselves as a partner of the ordering institutions of the Laender. As a partner we are highly interested to jointly solve the problem of substantially decreasing budgets by offering innovative solutions. However, in order to do so the ordering institutions will have to tender services on the basis of net contracts. That means that the train operating companies fully receive the revenue from passenger fares and thus take on the entrepreneurial risks and chances. Only then will DB Regio be able to bring in and utilise its wide-ranging transportation competencies. We fundamentally believe that through net contracts that give bidding companies the flexibility to act as creative entrepreneurs, our passengers as well as the public will benefit the most.

Net contracts are also crucial to give a train operating company an incentive to seriously care for its customers. DB Regio has recognised the rising importance of the passenger side of the market. Thus we are heavily investing in new rolling stock in order to optimise performance and increase customer satisfaction.

We have introduced several innovative fares especially in the leisure travel segment to attract new customers and increase the load factor. The key to success for us seems to offer fares that appeal to various market segments while decreasing the complexity of the pricing system. For instance, we have recently extended our flat-rate fares to make them usable at weekends. In 2005 revenue from those special fares has risen by 15 per cent. Through the new loyalty program ‘bahn.bonus’ we will further tie frequent customers to our products and services. ‘bahn.bonus’ will allow us to better understand the needs of our most valuable customers in order to give them the best service possible.

DB Regio is well positioned to meet the ordering institutions’ demands at the passenger side. Our modern rolling stock is already fulfilling many of the requirements in terms of accessibility for the various customer groups. Another element to improve our service quality is a program to extend the responsibilities of our staff. Passenger information is one of our core competencies. We do have one of the most sophisticated technological systems worldwide that enables passengers to retrieve all relevant information through multiple channels.Our service staff, for instance, can use smart phones to provide customers with real-time information about connecting trains in the case of disturbances.

We are convinced that these strategies will help us better satisfy our customers. As a first result our customer satisfaction index has reached a five year high in 2005. However, to succeed in biddings we must also put a strong focus on constantly optimising our cost structure and processes.

Although some of our competitors agreeably have an advantage here, we currently watch a couple of them placing offers at strategic, sometimes irrational prices. We believe that dumping prices do harm the market. They harm the passengers, who suffer from a bad quality in service. They harm the industry of train operating companies that require a solid financing in order to invest in assets. And, ultimately, they also harm the Laender over the long run, as they have to cope with dissatisfied passengers and voters and with train operating companies getting into financial distress. Therefore, DB Regio is not going to play this game and only place competitive but reasonably calculated offers.

Figure 1: Deutsche Bahn - organisational structure

Figure 2: DB Regio AG - Key figures 2004

Figure 3: Tenders placed (in million train kilometers)

Figure 4: Outlook on the development of prices in the regional transport market

Stay Connected with Global Railway Review — Subscribe for Free!

Get exclusive access to the latest rail industry insights from Global Railway Review — all tailored to your interests.

✅ Expert-Led Webinars – Gain insights from global industry leaders

✅ Weekly News & Reports – Rail project updates, thought leadership, and exclusive interviews

✅ Partner Innovations – Discover cutting-edge rail technologies

✅ Print/Digital Magazine – Enjoy two in-depth issues per year, packed with expert content

Choose the updates that matter most to you. Sign up now to stay informed, inspired, and connected — all for free!

Thank you for being part of our community. Let’s keep shaping the future of rail together!