The key role of alternative fuels in the decarbonisation of Europe’s rail sector

Posted: 5 April 2022 | Jonathan Cutuli | No comments yet

With the European Union focusing more on confronting climate change, Jonathan Cutuli, Public Affairs Manager at UNIFE, explains the key role that alternative fuels can play for the rail sector in lowering GHG emissions and how investment is key to producing greener results.

Mounting efforts to confront climate change have become one of the main challenges of the European Union (EU) in the recent years. With the 2019 European Green Deal, European institutions officially committed themselves to making Europe the first carbon-neutral continent by 2050. This objective has dictated the EU framework toward achieving net zero emissions by moving towards a low-carbon economy while also keeping high efficiency standards. All the key economic sectors and industries have been asked to massively contribute to the reduction of their carbon footprint. To address the transport sector’s shortcomings in this area, the EU launched the Sustainable and Smart Mobility Strategy in 2020 to spur on a 90 per cent reduction in transport-related greenhouse gas (GHG) emissions by 2050, followed by the ambitious Fit for 55 package of legislative proposals in July 2021. The latter aims to revise the EU’s entire climate and energy framework to lower GHG emissions by at least 55 per cent by 2030.

The transport sector accounts for approximately 25 per cent of the EU’s GHG emissions, emitting more pollutants than any other sector except for energy production. Yet, rail stands out as the mobility exception; it is the greenest mode of mass transportation, responsible for less than 0.4 per cent of transport related GHG emissions and has managed to steadily improve its energy efficiency since the 1990s.

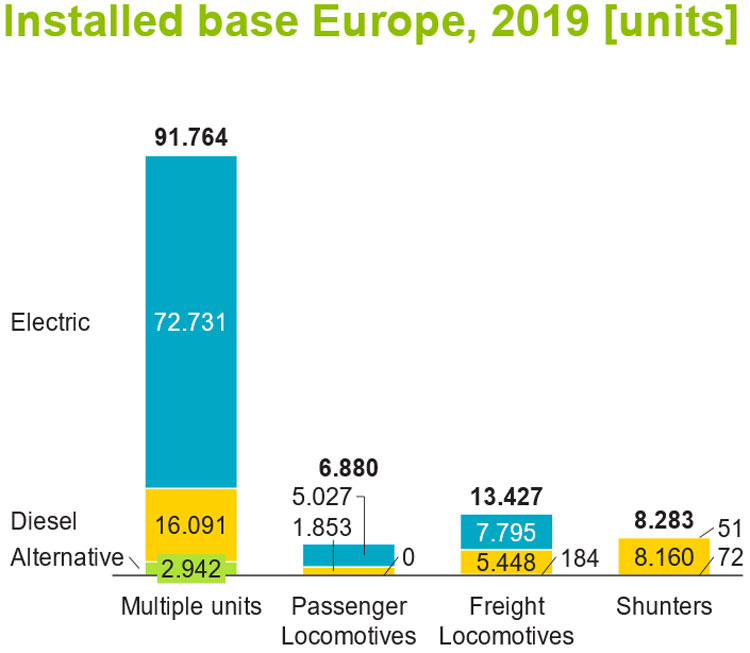

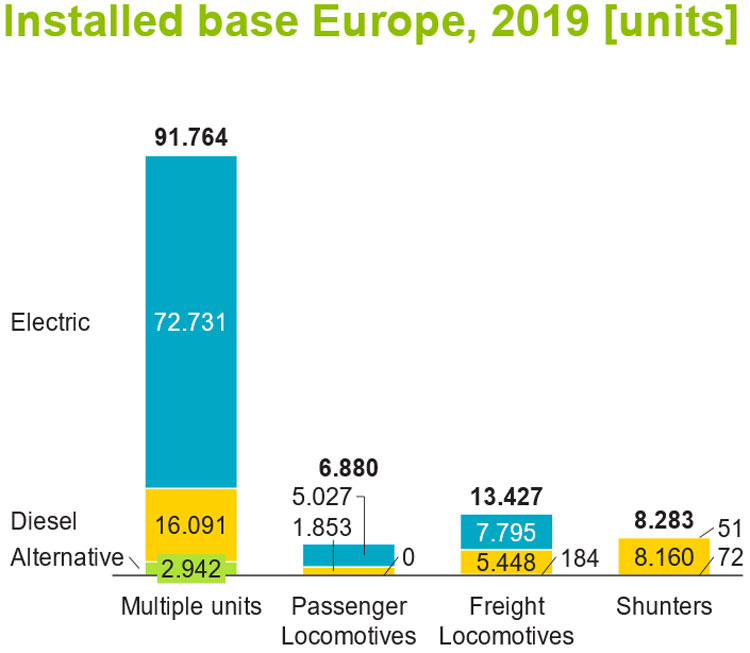

However, only 54 per cent of the current European rail network is electrified as of today, meaning that a significant number of diesel trains/locomotives are still in service. The 2020 World Rail Market Study (WRMS) found that diesel rolling stock’s market share currently accounts for 17 per cent of passenger multiple cars (roughly 16.091 multiple units out of 91.764) and 27 per cent of passenger locomotives (approximately 1.853 units out of 6.880). Diesel freight locomotives represents an even larger share (40 per cent) due to the low electrified tracks’ share (roughly 5.448 units out of 13.427).

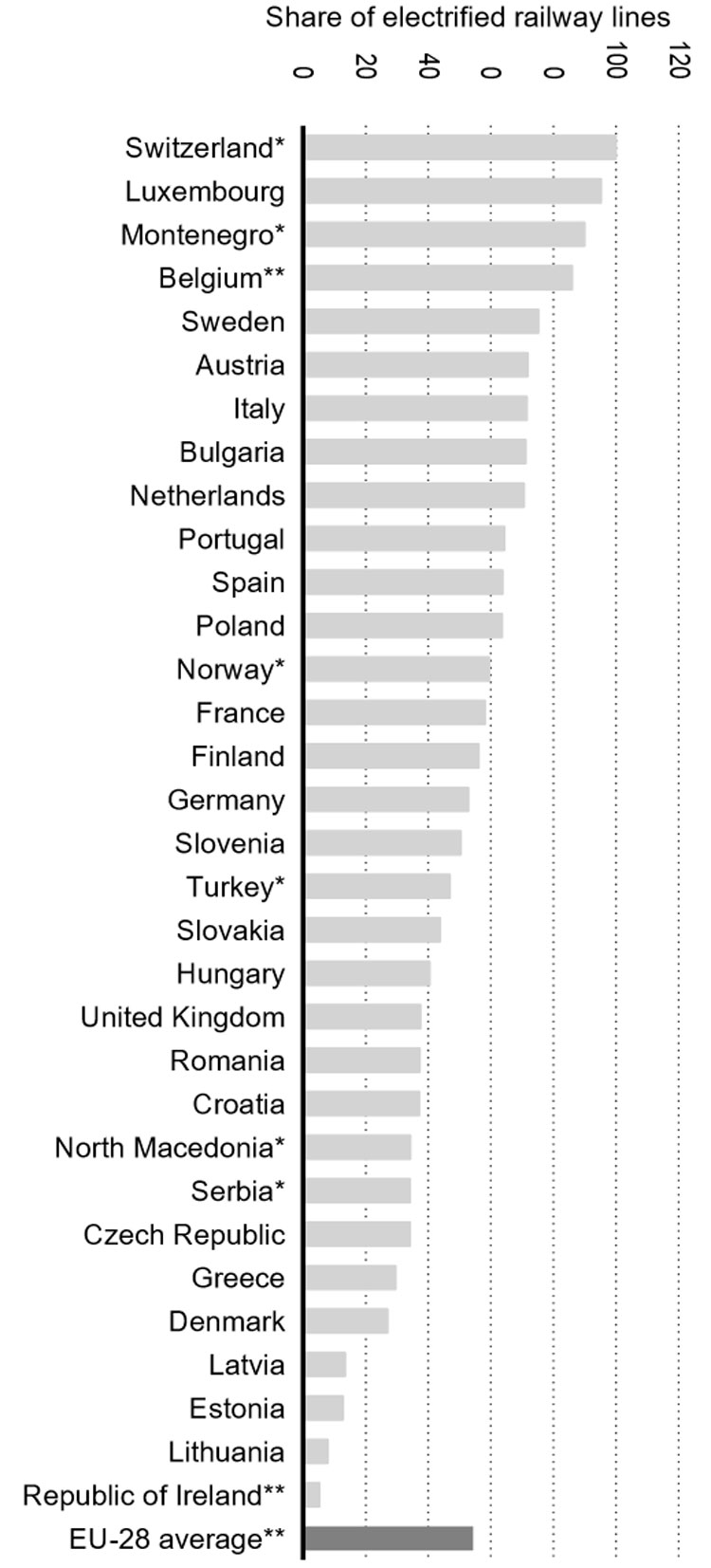

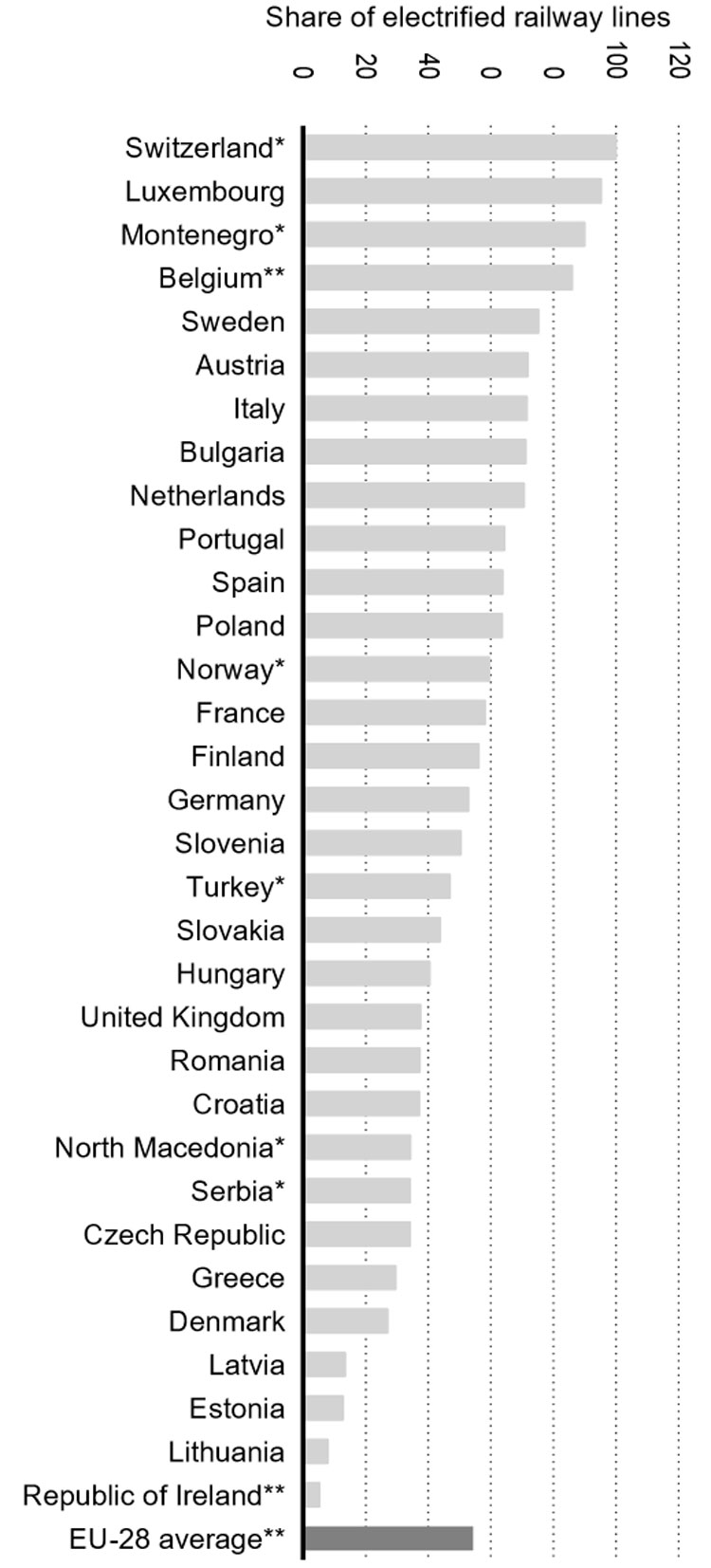

Considering the electrification’s share of the European rail network, Europe can be grouped in to the following three main subcategories:

- Above 60 per cent: only the Swiss rail network is completely electrified. However, they are followed (in descending order) by Luxembourg, Belgium, Sweden, Austria, Italy, Bulgaria, Netherlands, Portugal, Spain and Poland.

- Between 40 per cent and 60 per cent per cent: France, Finland, Germany, Slovenia and Slovakia.

- Less than 40 per cent: Hungary, United Kingdom, Romania, Croatia, Czech Republic, Greece, Denmark, Latvia, Estonia, Lithuania and Ireland.

This scenario clearly shows that clean technologies and alternative fuels represent one of the fastest and most appealing growing markets in Europe, bolstered by several exciting technological innovations. The alternative fuels rolling stock market is expected to grow by +1.4 per cent in Western Europe and by +5.5 per cent in Eastern Europe between 2023-2025, according to the 2020 WRMS. This slight discrepancy is merely because the Eastern European rail network is currently less electrified than that in Western Europe.

Main advantages of the alternative fuel solutions in the rail sector

As recalled in the recent Study on use of fuel cells and hydrogen in railway environment, hydrogen fuel cell technology and battery-powered traction solutions proved to have reached an important technological maturity level over the years and, when applied, have demonstrated promising results in reducing GHG emissions. Thus far, these tools represent the main alternatives available on the market as stakeholders seek to eventually replace diesel traction trains and further reduce the sector’s carbon footprint. This is especially needed for those network segments where electrification is not currently considered a viable option due to economic and/or logistical barriers.

Battery-powered trains have the advantage of being able to charge easily and do not require significant amounts of additional infrastructure, even though they might require some operational constraints resulting from their highly route-specific tailored battery configurations. Fuel cell solutions offer longer ranges and refuel faster than batteries. Fuel Cell and Hydrogen-powered (FCH) trains can be effectively utilised on last mile delivery routes and main routes with limited frequency (i.e., up to 10 trains per day). Both solutions are highly promising technologies that can play an essential role in the shift towards a lower emission mobility system.

In one of the latest reports published by the European Clean Hydrogen Alliance in October 2021, as part of its exploration of the rail sector’s potential usage, it is stated that up to 70,000km of railway lines in Europe would remain unelectrified under the current EU legal framework, corresponding with the Trans European Network-Transport’s (TEN-T) completion, by 2050. Therefore, green propulsions systems must be seriously considered by Member States as technical alternatives to diesel for such lines, via the clear definition of decarbonation roadmaps for their non-electrified rail infrastructure that are implicit in how it would contribute to the 2050 objective of achieving a 90 per cent reduction in CO2 emissions. The report more specifically identifies the regional rail projects as being the main target for the most predictable long-term demand for green hydrogen and, as such, the deployment of hydrogen refuelling stations for regional passenger train applications is expected to be the most promising market segment.

The future is now: Member States investments and European financial support in greener rail propulsion solutions

Recently, many Member States have been significantly benefitting from the financial resources made available by the Recovery and Resilience Facility (RRF), which allow for massive investments into the development of alternative fuel solutions across the rail sector. Most notably Italy, the RFF’s main beneficiary, decided to allocate €300 million, out of a possible €29.4 billion eligible for rail-related investments, to alternative fuels rail infrastructure projects. The Italian Recovery Plan allocates this amount particularly for hydrogen testing on non-electrified lines and the purchase of 50 hydrogen trains for various segments of the national railway network.

Spain is also expected to invest €64 million, out of €6.4 billion set aside for disbursement to the sector. Projects are planned to support the renovation, or adaptation, of railway tractor equipment with other materials using alternative fuels such as hydrogen or electricity. Similarly, Romania promised to earmark €15 million of their €5 billion projected rail spend for the purchase of new rolling stock and installation of hydrogen refuelling infrastructure. Some European countries have also recently signed agreements for the development of hydrogen-based trains and locomotives, while others have already tested and ordered the first hydrogen-based trains. This is the case for France with SNCF engaging in a long-term plan to advance the energy transition and eliminate diesel from the rail network by 2035; Germany where DB has committed to climate-neutrality by 2040 and put in service the Coradia iLint™, the world’s first hydrogen powered train which was awarded the European Railway Award in 2021 and the prestigious German Sustainability Design Award in 2022, recognising its contribution to sustainable, zero-emission rail mobility solutions; the UK with Network Rail being the world’s first railway company to set the most ambitious science-based targets to limit global warming; the Netherlands where NS has been implementing new hydrogen-powered trains; and Austria, where ÖBB has cooperated with Shift2Rail on a pioneer project investigating the usage of hydrogen rail vehicles for passenger traffic.

At the European level, December 2021 saw the European Investment Bank (EIB) launch the Green Rail Investment Platform, a new instrument conceived to assist and fast track the implementation of rail investments by offering the lending, blending and advisory services of the EIB and EU financial instruments available under the InvestEU programme. The platform is available to all rail sector stakeholders and transport authorities to address specific market needs, explore new business models and boost opportunities to finance innovation and climate action opportunities from our mode of transport. The EIB expects the rail sector to focus on making the railway network greener by introducing battery-powered or hydrogen-powered vehicles on non-electrified sections through further developments and investments in this area over the coming years.

UNIFE’s stance on the use of alternative fuels solutions in the rail sector

UNIFE (the European Supply Industry) members are committed to contributing to the deployment of alternative fuels infrastructure in Europe to mitigate the environmental impact of transport and minimise the continent’s dependence on oil to diversify and secure the EU’s energy supply. The role of electrification and green propulsion systems, such as hydrogen fuel cells and battery-powered trains, assumes tremendous significance for European rail suppliers now more than ever as we move to decarbonise the lines that still rely on diesel engines, and unfortunately, probably will for the decades to come. Considering that the lifecycles of rail assets are long, a diesel train or locomotive that is ordered today can be in operation beyond their anticipated lifetime, so urgent decarbonisation measures need to be put in place now to reach net-zero emissions, as stipulated in both the EU Green Deal and the Fit for 55 proposals.

For this reason, the ongoing discussions surrounding the European Commission’s Fit for 55 proposal for a new Regulation on Alternative Fuels Infrastructure (AFIR) and the continuing TEN-T Regulation revision, represent an unprecedented opportunity for UNIFE to help establish a European legal framework that supports the deployment of alternative fuels infrastructures for rail, especially for those lines that are not mandated to be electrified under the TEN-T or those that do not belong to the network.

Although welcoming rail’s inclusion in the AFIR proposal, UNIFE members regret that the rail-related provisions do not appear as ambitious as the ones envisioned for other modes of transport. In particular, the absence of national mandatory targets related to the installation of charging stations for battery-powered trains and hydrogen refuelling stations for rail is of major concern for the rail suppliers. These are essential, especially for those network segments that will not be required to electrify. Planning the full roll-out of alternative fuels infrastructures across the rail network would be consistent with the eligibility of hydrogen refuelling infrastructures for the sector under the Connecting Europe Facility 2 (CEF2) Work Programme [Annex to the Commission’s Implementing Decision ‘on the financing of the Connecting Europe Facility’; Transport sector and the adoption of the work programme for 2021-2027; 6.2.2. Actions related to sustainable and multimodal mobility – Alternative fuels infrastructure.]

With regards to the TEN-T proposal’s intersection with AFIR, UNIFE believes that the potential to further decarbonise the rail sector with the support of alternative fuels as a complement to overhead line electrification is not being properly considered. The current proposal does not fully realise calls for an “adequate and concerted deployment of requirements [for the alternative fuel infrastructure rollout] across Europe for each transport mode […] in order to obtain the benefits of the network effect and to make efficient long-range trans-European transport operations possible” made in the document’s introduction.

These two complementary legislative texts should ultimately enable European rail to proceed on a path towards full decarbonisation and allow the sector to lead the green transition in the coming years.

Issue

Related topics

Diesel Locomotives, Electric/Hybrid Rolling Stock, Electrification & Cabling, Hydrogen Trains, Regulation & Legislation, Sustainability/Decarbonisation

Related organisations

Alstom, Community of European Railway and Infrastructure Companies (CER), Deutsche Bahn AG (DB AG), European Commission (EC), European Investment Bank (EIB), European Union (EU), Europe’s Rail Joint Undertaking (EU-Rail), Network Rail, SNCF, UNIFE (the European Rail Supply Industry)